#Economic publications

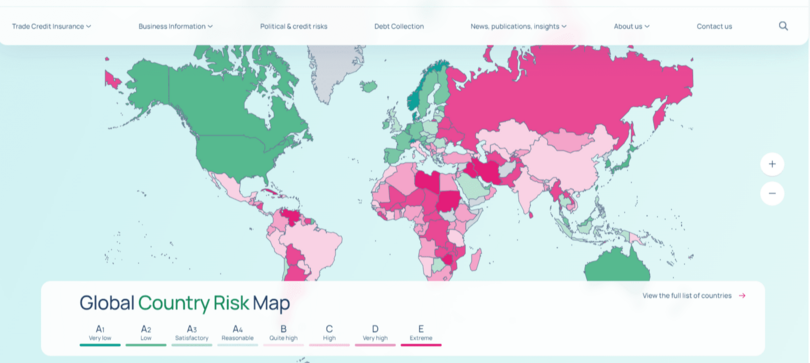

Discover our Country Risk Map. Thanks to our country and sector risk assessments, take the right decisions for your company. Our experts regularly analyse the risks in more than 162 countries around the globe, and for the 13 most critical sectors of the world economy.

Discover at a glance the business risk profile of each of your international markets. For each country, you have access to our experts' detailed risk assessment and outlook.

Coface defines country risk as the average probability of default on an international commercial transaction in a specific country within the next six months. This knowledge enables internationally active companies to better assess the stability of the business environment - and to make better decisions.

Coface’s country risk assessment relies on a structured model that combines a long-term structural analysis with a short-term macroeconomic evaluation. This dual approach provides a comprehensive view of the risk of payment defaults in international trade, helping businesses navigate global markets with greater confidence.

The structural assessment is based on five long-term dimensions that reflect the underlying resilience and stability of a country’s economic and institutional environment. First, economic development looks at the level of income, employment, and diversification of the economy. Second, fiscal sustainability assesses the strength of public finances, including debt levels, budgetary health, and financing capacity over time. Third, political risk evaluates the stability of institutions, policy coherence, and the risk of conflict or social unrest. Fourth, quality of governance considers administrative efficiency, legal frameworks, transparency, and the broader business climate. Finally, sensitivity to climate risk captures both physical vulnerability to climate-related events and the country’s capacity to manage an environmental transition.

Alongside this, the cyclical assessment focuses on short-term macroeconomic conditions. It analyzes the immediate economic outlook—such as GDP growth, inflation, trade performance, and monetary pressures—to determine whether the near-term dynamics warrant an upgrade, downgrade, or confirmation of the existing rating.

These insights are integrated through a three-step process. Coface first calculates a structural risk score, then applies a cyclical recommendation based on current economic trends. Finally, this recommendation is filtered through a “structural corridor” that ensures coherence with long-term fundamentals and avoids abrupt rating fluctuations.

Beyond this quantitative framework, Coface's country risk ratings benefit from the experience of its economists and risk underwriters, who bring local knowledge, qualitative insights, and proprietary data on company payment behavior. This combination makes the assessment both rigorous and grounded in real-world conditions.

The Coface scale goes from A to E, where A denotes a very low risk of default and D and E denote a very high probability of default. Regarding E, we specifically advise against conducting any business in these nations since they are either under US sanctions or are engaged in a financially devastating war. In contrast, A is further broken into grades that range from A1 (extremely low risk) to A4 (moderate risk) in order to highlight the disparities among industrialized countries. You can find the latest changes in our Business Risk Dashboard.

In addition to country risks, each quarter Coface also analyzes sectoral risks for 13 major sectors of the global economy. Each time for the following six regions: Asia-Pacific, Central and Eastern Europe, Latin America, Middle East and Turkey, North America and Western Europe.

here, Coface assessments are based on more than 70 years of expertise. A methodology based on criteria integrated in 3 main pilars : Coface’s expertise and payment experience data, external financial data forecasts (quantiles) other criteria (commodities prices forecast, structural changes, Country risk assessment).

Protect your companies operations against credit risk internationally. With Coface trade credit insurance, your cash-flow is protected regardless of the size of your company. You therefore have the necessary time to focus only on your core activities.

Discover the credit insurance solution tailored to your needs

Tailor-made protection for your complex transactions with long-term maturities. Your large-scale and one-off projects are then protected against political and credit risks, worldwide.

Click the link below and arrange a telephone consultation with one of our experts now.

#Economic publications

#Economic publications

#Economic publications

#Economic publications

Online services for customers and brokers

CofaNet Essentials

Manage your contracts with our customer portal.

Business Information

Access to the business insights you need to manage risk and make informed decisions.

Broker Portal

Platform dedicated to brokers.

Innovative and digital solutions

API Portal

Explore Coface's catalog of APIs and integration solutions for our business information and credit insurance services.